In order for someone to invest in a particular stock market, one would need the local currency in order to purchase stocks.

You can imagine what the effect of stock markets like the DAX (that's the German stock market), have on currencies.

In theory, whenever the DAX rises, we can probably expect the euro to rise as well, as investors need to get a hand on some euros.

While the correlation is imperfect, statistics show that it still holds pretty accurately.

We here at BabyPips.com did a little research of our own and found out that EUR/JPY seems to be highly correlated with stock markets across the globe. You should know that the yen, along with the U.S. dollar, are considered to be safe havens amongst the major currencies.

Whenever confidence in the global economy is down and traders are fearful, we typically see traders take their money out of the stock markets, which leads to a drop in the values of the DAX and S&P500.

With money flowing out of these markets, we usually see EUR/JPY fall as traders run for cover. On the flip side, when the sun is bright and risk appetite is rampant, investors pour their money into stock markets, which in turns leads to a rise in the EUR/JPY.

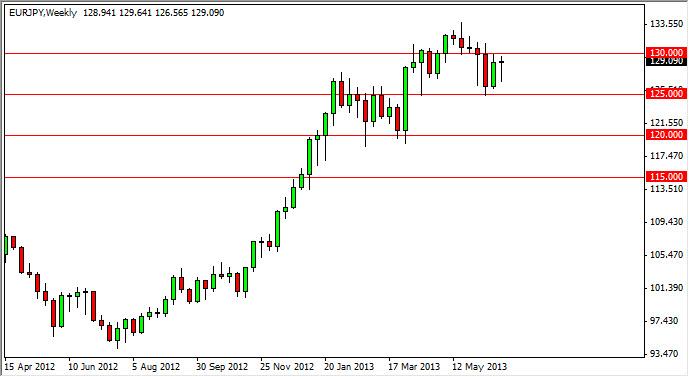

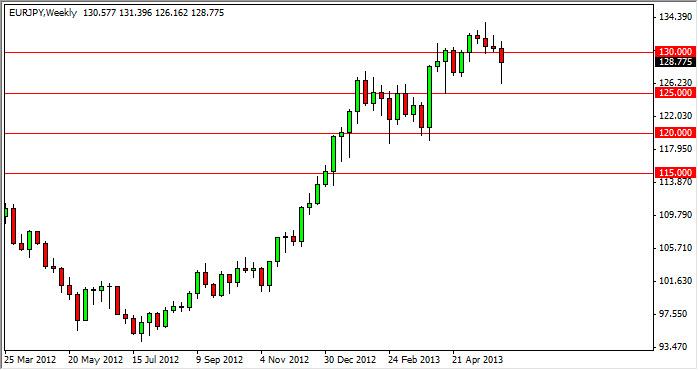

Take a look at charts below to see the correlation between the EUR/JPY and the DAX and S&P500.

The correlation seems to have held well this past decade, as EUR/JPY and both indexes rose steadily together, until 2008, when we were hit with the financial crisis. In late 2007, EUR/JPY had hit its peak, and so did the stock indexes.

If you want to see the raw data for yourself, check out

Yahoo! Finance

This a great place to start digging and doing your own research.

The site offers historical price data for almost all currency pairs and equity markets.

You can compare historical prices and come up with your own barometers of risk.