InstaForex has already proven itself as one of the best brokers worldwide. Numerous prizes and awards, more than a million accounts of clients from all over the world – that is the best evidence of broker's merits. Every day we diligently improve our services to make trading with InstaForex not only comfortable but also beneficial. That is why high achievements of our clients are the best award for the company.

Recently we told about an astounding success of trader millionaire Akhmad Arief who managed to earn $1,000,000 just in two weeks. And now the story repeats, but this time the Lady Luck has picked up Sergei Kovalenko from Belarus. He has not only achieved Akhmad’s record but even improved it up to $1,500,000!

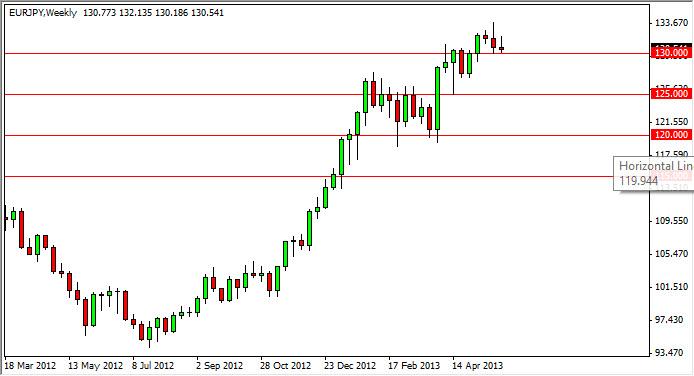

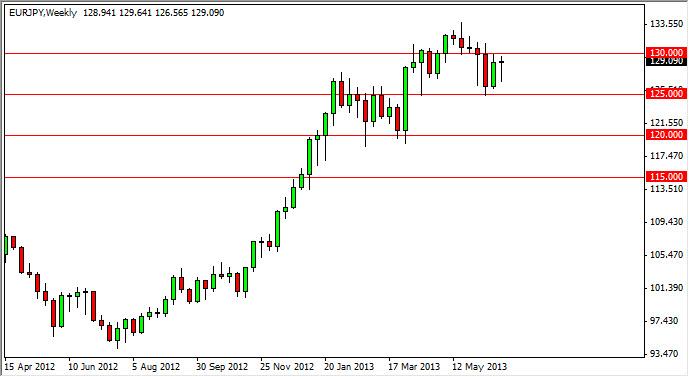

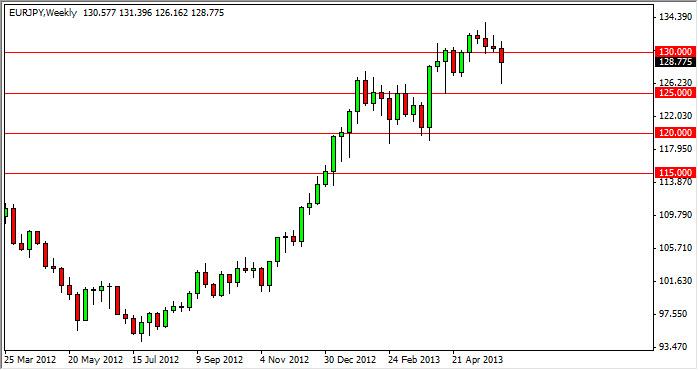

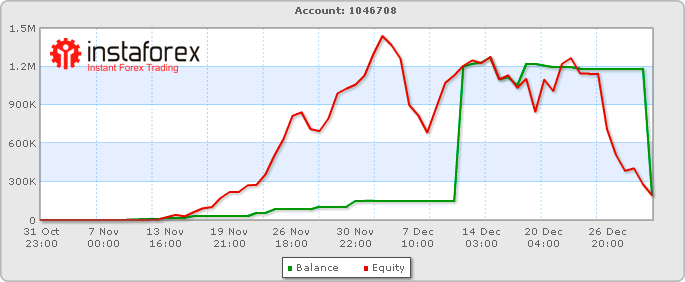

The chart depicts the dynamics of Sergei’s trading balance. Since November 13, 2012 and within two weeks the trader was demonstrating a stable increase in profit. Later there were some insignificant losses and then an incredible hike in earnings during the first days of December. As of December 4, at 17:00 the balance hit $1,464,992.92 million. The rest of the month was more or less successful for Sergei but at the end of December the profit was lost.

"Prolonged and laborious work eventually helped me to successfully enter the market and take profit. Of course, I have made many mistakes, but now I have got a deeper understanding of my actions; I can rationally consider my abilities and knowledge. As the result, I have new goals!" - Sergei shares his impressions.

Unfortunately, new millionaire could not keep the victory for long and quite soon the balance started to decrease and the cherished sum of money was lost. However, Sergei is not in despair, he is analyzing his actions and is getting ready to conquer another high of $2,000,000.

"The luck is short-lived, you cannot count on it - only work, studies and understanding the market can bring good results. I have experienced that myself."

InstaForex wishes Sergei to achieve new goals. We hope that every company’s client will find the way to successful trading gaining full support from InstaForex.

Sergei's Kovalenko Interview

Sergei's Kovalenko Interview

InstaForex: How long have you been on Forex?

Sergei: I started my way on Forex in late 2004 after hefty losses within HYIPs. By the way, I’m still studying; I keep attending various training courses, etc. Trading is not a game for me, but a job.

InstaForex: Which trading platform do you employ?

Sergei: I mostly trade using MetaTrader 4.

InstaForex: Do you pay attention to analytical reviews when trading?

Sergei: Yes, I definitely do. I actually mull over plenty of information before I decide to open a trade. All factors matter, even those related to astrology.

InstaForex: What leverage do you trade with?

Sergei: Leverage depends on the amount of your deposit. As a rule, I start with the largest leverage possible with my broker.

InstaForex: How could you explain the fact that you made a fortune with a relatively small initial deposit?

Sergei: It’s a result of a daily grind. Thanks to hard work, I managed to successfully enter the market and lock the profit in. I did make a lot of mistakes, but through time I have grown more aware, concentrated. Moreover, I have developed a sober mind, the ability to give my skills and knowledge realistic estimates. Now I’ve got new aims ahead! My nearest target is earning $2 million.

InstaForex: Which currency pairs do you prefer and why?

Sergei: I trade eight currency pairs. This quantity of currency instruments suits me best, as I have enough time to make profound analysis and build some forecasts. But I only enter the market if there’s a clear signal and the time and

date coincide for a certain pair.

InstaForex: Which indicators do you rely on?

Sergei: I’m one of the Gann masters at the online academy, so I prefer Gann methods.

InstaForex: What timeframe do you usually choose?

Sergei: Basically, I opt for H1.

InstaForex: Is this sum exactly what you had planned to earn at

the very start?

Sergei: Of course, it’s not. After I lost around $150,000 in HYIPs, my only dream was to pay the debts. But very soon, in summer of 2012, I could make as much as $450,000. And that was when I set my first aim — $1 million. I hit it in

December.

InstaForex: You made huge accomplishment indeed. How do you feel about the loss? What conclusions did you draw?

Sergei: My conclusions are as follows: mistakes are great lessons to learn; never give up and rush forwards with your head cool! As for the loss, what can I say... It frustrated me of course, but what makes me glad and proud is the fact that I DID IT!!! And I will do it again!

InstaForex: Will you go through it all again?

Sergei: No doubt, YES!

InstaForex: If you succeed once again, what will you spend the money on?

Sergei: I will dedicate it to charity. I own a house in Cyprus, and I already bought a house for my parents too. So, I don’t need anything for myself.

InstaForex: What do you think help traders to make money on Forex ― years of practical experience or luck?

Sergei: Luck is evasive; it is not worth relying on. Good results are fuelled by hard work, studying and understanding the market. This is what I realized after years of trading.

InstaForex: Do you consider your profit to be a result of hard work or just a fluke?

Sergei: I don’t mean to brag, but I think it’s the fruit of my labour.

InstaForex: What would you advise beginners to do?

Sergei: First of all, get rid of illusions like "I will become rich with $100". You really need to study the basics of the currency market and find a good teacher, an expert in trading! Jokes aside, all you need is love trading. As a financier, I’m fond of figures. This realm is my vocation. And I wish everyone to enjoy the job!

_________________________________________________________

The above original article can be found here:

https://cabinet.instaforex.com/partner/sk/news/company_news/1/3207

Sergei's Kovalenko Interview

Sergei's Kovalenko Interview