Regards From Nelayan Forex Traderlog

Telah aku serahkan

asa terakhirku buatmu

Telah aku hulurkan

depa tangan penghabisan untukmu

Telah juga aku hamparkan

denai penghujungan kepadamu

Telah turut aku hadiahkan

ruang upaya penamatku bagimu

..

Namun kau makin menjauh

Menghanyut benak dan minda di hujung waktu

..

Masih adakah esok sebagai lembah harapan?

Masih adakah esok sebagai dataran impian?

..

Sedang lafaz tidak kunjung niat

Sedang niat tidak kunjung amalan

Sedang amalan tidak kunjung istiqamahnya

..

Masihkah aku harus menanti?

Mengharap esok pelangi meniti mentari

Lantaran sinarnya semakin surut

Menjejak kaki mega senja

Tanda alam semakin menganjak usia

..

Ya ALLAH!

Di sujud ini aku merintih

Pandulah aku memimpin diri

Antara mimpi dan realiti..

Ya Allah

hanya bagi-Mu segala puji

atas nikmat Kau kurniakan

Ya Allah Ya Rabbi

rahmatkanlah akan penghuluku, keluarga dan para

sahabatnya

rahmatkanlah akan segala anbia dan pesuruh-Mu

rahmatkanlah akan segala para wali dan syuhada

rahmatkanlah akan segala hamba-Mu yang beriman,

maka demi kebesaran dan kemuliaan-Mu

pula aku mohon kebajikan

pula aku mohon perlindungan,

berikanlah aku kekuatan imanku

banyak rezekiku panjang usiaku

dalam rahmat dan sejahtera-Mu.

Jauhilah daku dengan bala dan celaka

Jauhilah daku dengan dosa jahat dan duka nestapa

Ya Allah Ya Rahman

aku mohon limpah perkenan dan keampunan-Mu

aku mohon petunjuk dan keredaan-Mu.

Jadikanlah doaku ini tiang sinar cahaya

hikmatnya bisa menerangi ceruk rantau bumi

hikmatnya bisa menyapu buih-buih laut

hikmatnya bisa memindahkan setiap biji pasir Sahara.

Jadikanlah doaku ini senjataku

buatku perolehi kemenangan dunia akhirat-Mu

Ya Allah Ya Rahim

jauhilah umat-Mu

daripada pecah belah

jauhilah bangsaku

daripada lembah hina-dina

jauhilah kami

daripada jalan Kau murka

Ya Allah Ya Tuhanku

biar pada-Mu saja

kami berlindung.

Amin

Nukilan Rasa:

A Aziz Deraman

....

hanya bagi-Mu segala puji

atas nikmat Kau kurniakan

Ya Allah Ya Rabbi

rahmatkanlah akan penghuluku, keluarga dan para

sahabatnya

rahmatkanlah akan segala anbia dan pesuruh-Mu

rahmatkanlah akan segala para wali dan syuhada

rahmatkanlah akan segala hamba-Mu yang beriman,

maka demi kebesaran dan kemuliaan-Mu

pula aku mohon kebajikan

pula aku mohon perlindungan,

berikanlah aku kekuatan imanku

banyak rezekiku panjang usiaku

dalam rahmat dan sejahtera-Mu.

Jauhilah daku dengan bala dan celaka

Jauhilah daku dengan dosa jahat dan duka nestapa

Ya Allah Ya Rahman

aku mohon limpah perkenan dan keampunan-Mu

aku mohon petunjuk dan keredaan-Mu.

Jadikanlah doaku ini tiang sinar cahaya

hikmatnya bisa menerangi ceruk rantau bumi

hikmatnya bisa menyapu buih-buih laut

hikmatnya bisa memindahkan setiap biji pasir Sahara.

Jadikanlah doaku ini senjataku

buatku perolehi kemenangan dunia akhirat-Mu

Ya Allah Ya Rahim

jauhilah umat-Mu

daripada pecah belah

jauhilah bangsaku

daripada lembah hina-dina

jauhilah kami

daripada jalan Kau murka

Ya Allah Ya Tuhanku

biar pada-Mu saja

kami berlindung.

Amin

Nukilan Rasa:

A Aziz Deraman

....

SubhanALLAH! Indahnya bait-bait nukilan di atas. Semoga dalam kesibukan denai lopak perjuangan kita mencari dunia, masih utuh segumpal kalbu yang sentiasa menzahirkan syukur dan nikmat di atas segala limpah kurniaNya kepada kita. Dan semoga tidak pernah diizinNya kita menghambat sesat walau sesaat; melainkan hanya jejak RasulNya jua sahajalah yang kita gagahi dan kecapi. Maha Suci ALLAH, indahnya agamaMu. Alhamdulillah..

I was so far from You

Yet to me You were always so close

I wandered lost in the dark

I closed my eyes toward the signs

You put in my way

I walked everyday

Further and further away from You

Ooooo Allah, You brought me home

I thank You with every breath I take.

..

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah.

..

I never thought about

All the things You have given to me

I never thanked You once

I was too proud to see the truth

And prostrate to You

Until I took the first step

And that’s when You opened the doors for me

Now Allah, I realized what I was missing

By being far from You.

..

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah.

..

Allah, I wanna thank You

I wanna thank You for all the things that You’ve done

You’ve done for me through all my years I’ve been lost

You guided me from all the ways that were wrong

And did You give me hope

..

O Allah, I wanna thank You

I wanna thank You for all the things that You’ve done

You’ve done for me through all my years I’ve been lost

You guided me from all the ways that were wrong

I wanna thank You for bringing me home

..

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah.

..

Artist: Maher Zain

Album: Thank You Allah

Copyright: Awakening Records 2009

Yet to me You were always so close

I wandered lost in the dark

I closed my eyes toward the signs

You put in my way

I walked everyday

Further and further away from You

Ooooo Allah, You brought me home

I thank You with every breath I take.

..

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah.

..

I never thought about

All the things You have given to me

I never thanked You once

I was too proud to see the truth

And prostrate to You

Until I took the first step

And that’s when You opened the doors for me

Now Allah, I realized what I was missing

By being far from You.

..

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah.

..

Allah, I wanna thank You

I wanna thank You for all the things that You’ve done

You’ve done for me through all my years I’ve been lost

You guided me from all the ways that were wrong

And did You give me hope

..

O Allah, I wanna thank You

I wanna thank You for all the things that You’ve done

You’ve done for me through all my years I’ve been lost

You guided me from all the ways that were wrong

I wanna thank You for bringing me home

..

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah

Alhamdulillah, Elhamdulillah

All praises to Allah, All praises to Allah.

..

Artist: Maher Zain

Album: Thank You Allah

Copyright: Awakening Records 2009

GBP/USD Comments:

• César Leiceaga: Trading above the 38.2% Fib in 1.5500s but in a similar situation to the euro. Trendline broken and looking heavy.

• ecPulse.com: A daily closing below 1.5545 is needed to confirm the bearishness

• Mohammed Isah: GBP is trying to recover higher falling its recent declines but continues to face bear pressure at 1.5648. Sideways trading should dominate price action in the coming week but with risk resuming its declines. Within three months, we are bullish on the pair.

• Dr. Sivaraman: Last month of the year -GBP could make some aggressive gains

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

• Ilian Yotov: The GBP could stay in the upper $1.50's if the U.K. economic data remains strong and if risk appetite makes a comeback.

EUR/USD Comments:

• César Leiceaga: Severe change in trend to bearish after eroding the bullish trendline and 200SMA. Looking for a deeper retracement to 1.20 area over the next months.

• ecPulse.com: 1.2795 MUST be breached to confirm month & Quarter trends

• Mohammed Isah: Our bias for the coming week is slightly to the upside as we expect the pair to correct further itsrecent declines. In one week to one month sideways trading could grip EUR.Our overall outlook remains bullish in three months.

• Dr. Sivaraman: last month of the year -EURO could make some aggressive gains.

• Yohai Elam: Some form of European QE could slow the weakening of the Euro.

• Valeria Bednarik: EUR extreme oversold conditions come into play, and the common currency is regaining ground against major rivals; such gains could extend in EUR/USD towards 1.35/6 before bearish trend resumes

USD/JPY Comments:

• Alberto Muñoz: If 84,75 is taken, then expect a strong bullish movement.

• César Leiceaga: Recovery in place after gaining upward momentum during the week. We need 83.00 area to hold on a weekly close to resume the renewed bullish trend.

• ecPulse.com: Trading above 83.80 would confirm the bullishness.

• Mohammed Isah: Consolidation looks to dominate price action the coming week as USDJPY is now hesitating,halting its nearer term recovery off 80.23. Risk remains higher nearer term but we still retain our long term bearish call in one to three months.

• Dr. Sivaraman: Last month of the year - USD/YEN could make some appreciable gains.

• Yohai Elam: A shift in US bonds can support the pair. It seems that USD/JPY found a bottom and it's slowly making it's way up.

• Valeria Bednarik: Downside continues limited in the pair, and further gains are still likely mid term talking. Consolidation Above 0.9700 is needed to keep the bias valid.

• Ilian Yotov: Improvement in investor sentiment and risk appetite, coupled with stronger U.S. economic data and higher Treasury yields could become the catalysts for the USD to revisit the post-intervention highs around 86 yen.

Keys:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

• César Leiceaga: Trading above the 38.2% Fib in 1.5500s but in a similar situation to the euro. Trendline broken and looking heavy.

• ecPulse.com: A daily closing below 1.5545 is needed to confirm the bearishness

• Mohammed Isah: GBP is trying to recover higher falling its recent declines but continues to face bear pressure at 1.5648. Sideways trading should dominate price action in the coming week but with risk resuming its declines. Within three months, we are bullish on the pair.

• Dr. Sivaraman: Last month of the year -GBP could make some aggressive gains

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

• Ilian Yotov: The GBP could stay in the upper $1.50's if the U.K. economic data remains strong and if risk appetite makes a comeback.

EUR/USD Comments:

• César Leiceaga: Severe change in trend to bearish after eroding the bullish trendline and 200SMA. Looking for a deeper retracement to 1.20 area over the next months.

• ecPulse.com: 1.2795 MUST be breached to confirm month & Quarter trends

• Mohammed Isah: Our bias for the coming week is slightly to the upside as we expect the pair to correct further itsrecent declines. In one week to one month sideways trading could grip EUR.Our overall outlook remains bullish in three months.

• Dr. Sivaraman: last month of the year -EURO could make some aggressive gains.

• Yohai Elam: Some form of European QE could slow the weakening of the Euro.

• Valeria Bednarik: EUR extreme oversold conditions come into play, and the common currency is regaining ground against major rivals; such gains could extend in EUR/USD towards 1.35/6 before bearish trend resumes

USD/JPY Comments:

• Alberto Muñoz: If 84,75 is taken, then expect a strong bullish movement.

• César Leiceaga: Recovery in place after gaining upward momentum during the week. We need 83.00 area to hold on a weekly close to resume the renewed bullish trend.

• ecPulse.com: Trading above 83.80 would confirm the bullishness.

• Mohammed Isah: Consolidation looks to dominate price action the coming week as USDJPY is now hesitating,halting its nearer term recovery off 80.23. Risk remains higher nearer term but we still retain our long term bearish call in one to three months.

• Dr. Sivaraman: Last month of the year - USD/YEN could make some appreciable gains.

• Yohai Elam: A shift in US bonds can support the pair. It seems that USD/JPY found a bottom and it's slowly making it's way up.

• Valeria Bednarik: Downside continues limited in the pair, and further gains are still likely mid term talking. Consolidation Above 0.9700 is needed to keep the bias valid.

• Ilian Yotov: Improvement in investor sentiment and risk appetite, coupled with stronger U.S. economic data and higher Treasury yields could become the catalysts for the USD to revisit the post-intervention highs around 86 yen.

Keys:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

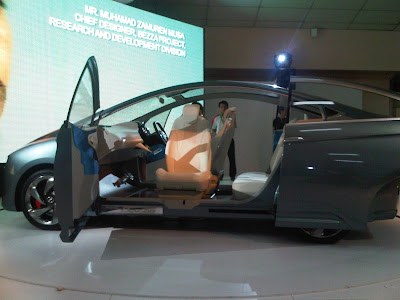

Tengahari Sabtu, aku bawa anak dan isteri ke PWTC. Ada pameran KL International Motor Show 2010. Boleh tahan, walaupun mungkin tak setanding di Tokyo ataupun Paris. Banyak juga prototype yang dipamerkan, termasuklah Perodua Bezza (foto ketiga dari atas) dan versi siri 'Pahlawan' janaan Proton: Tuah, Jebat, Lekir (foto keempat dari atas), Lekiu dan Kasturi. Model-model terkini luar negara yang sedang dan akan memasuki pasaran tempatan juga turut dipamerkan, antaranya Nissan Teanna, Honda Insight, All-New Hyundai Sonata, Kia Sorento XM, Peugeot New207 dan Lexus LS600hL (sekadar menyebut beberapa jenama).

Turut dipamerkan adalah siri-siri model jenama mewah seperti Lotus, Porsche, Lambourghini, Ferrari, Masserrati, Brabus dan Mercedes. Tidak turut ketinggalan, pameran segmen motorbike daripada jenama unggul seperti Harley-Davidson, Aprillia dan Ducati juga menarik perhatian para pengunjung.

Namun, aku pastinya paling tertarik pada All-New Kia Optima yang hanya akan tiba di pasaran Malaysia pada tahun hadapan. Entah bila yang lama akan berganti baru.. :-)

Ku berserah padaMu, Ya ALLAH..

Albert Einstein pernah dipetik sebagai berkata:

".. the most powerful force in the universe is compound interest."

Dengan terma rujukan kita sebagai seorang Muslim, ia boleh kita terima dengan limitasi kepada konteks unsur 'baharu' hasil penemuan aqliah pemikiran seorang manusia ciptaan ALLAH Yang Maha Esa.

Ironinya, bagaimana seorang "a great man of science" memandang tinggi kepada sebuah konsep matematikal dan ekonomi. Malahan di dalam dunia Forex, konsep 'compound interest' merupakan salah satu elemen motivasi utama yang mengikat para pengamalnya kekal menjuarai kecekalan dan ketabahan untuk terus berjuang mencapai matlamat yang diidamkan. Dalam lain perkataan, ia menghayati konsep exponential growth yang secara amali dipraktikkan dalam teorem-teorem amaliah para sarjana bidang-bidang sains, matematik dan ekonomi.

Pun begitu, aku tidak berhajat untuk menulis tentang konsep tersebut. Setidak-tidaknya, bukan kali ini. Mungkin di dalam tulisan-tulisanku yang akan datang, aku akan berkesempatan mengulasnya. Lagipun, ia bukan asing lagi buat para pedagang Forex hari ini. Maklumat berkenaannya semudah menaip kata kunci "compound interest" dalam enjin carian Google dan.. nahh!! Dalam masa 0.11 saat sahaja, sebanyak sekurang-kurangnya 3,150,000 hasilan akan disenaraikan!

".. the most powerful force in the universe is compound interest."

Dengan terma rujukan kita sebagai seorang Muslim, ia boleh kita terima dengan limitasi kepada konteks unsur 'baharu' hasil penemuan aqliah pemikiran seorang manusia ciptaan ALLAH Yang Maha Esa.

Ironinya, bagaimana seorang "a great man of science" memandang tinggi kepada sebuah konsep matematikal dan ekonomi. Malahan di dalam dunia Forex, konsep 'compound interest' merupakan salah satu elemen motivasi utama yang mengikat para pengamalnya kekal menjuarai kecekalan dan ketabahan untuk terus berjuang mencapai matlamat yang diidamkan. Dalam lain perkataan, ia menghayati konsep exponential growth yang secara amali dipraktikkan dalam teorem-teorem amaliah para sarjana bidang-bidang sains, matematik dan ekonomi.

Pun begitu, aku tidak berhajat untuk menulis tentang konsep tersebut. Setidak-tidaknya, bukan kali ini. Mungkin di dalam tulisan-tulisanku yang akan datang, aku akan berkesempatan mengulasnya. Lagipun, ia bukan asing lagi buat para pedagang Forex hari ini. Maklumat berkenaannya semudah menaip kata kunci "compound interest" dalam enjin carian Google dan.. nahh!! Dalam masa 0.11 saat sahaja, sebanyak sekurang-kurangnya 3,150,000 hasilan akan disenaraikan!

Sebenarnya, aku tertarik dengan sebuah lagi penemuan hebat akal manusia hasil izin Dia Yang Maha Kuasa. DNA! Atau istilah penuhnya, Deoxyribo Nucleic Acid. Penemuan struktur "double-helix" DNA oleh James D. Watson dan Francis Crick pada 1953 telah membuka sebuah lembaran baru kepada sejarah pengkajian hidupan di peringkat genom dan biologi sel yang sehingga kini membawa kepada lahirnya era industri Bioteknologi dan Kejuruteraan Genetik. Untuk rekod, kedua-dua saintis, bersama-sama dengan Maurice Wilkins telah dianugerahkan Hadiah Nobel di dalam bidang Fisiologi/ Perubatan pada tahun 1962.

Kenapa DNA? Apa ada kaitannya dengan Forex? Adakah mungkin kaitannya struktur "double-helix" DNA itu dengan struktur "open positions" pada Forex? Apakah ada sesuatu yang boleh diambil pengajaran jika kita membandingkan bes-bes A, C, G dan T pada struktur "double-helix" tersebut dengan susunan-susunan "bid" dan "ask" harga pair pada struktur "open positions" di dalam Forex? Wallahu A'lam.

Jika "compound interest" yang merupakan sebuah teorem Matematik dapat dikaitkan dengan bidang Ekonomi, tidak mustahil dengan sedikit pengubahsuaian, konsep struktur "double-helix" DNA juga boleh 'diserasikan' ke dalam bidang yang lain.

Berbaik sangkalah kita terhadap keizinanNya..

Wallahu A'lam.

EUR/USD Comments:

• Adam Narczewsk: There is still a downside potential for the EUR/USD but I believe in a rebound as the investment world calms down after the "Irish crisis" and takes into account the macro news showing recovery

• Mohammed Isah: With attempts on the upside meeting bear pressure at 1.3781 and turning EUR back lower through the 1.3445 level on Nov 23'10, nearer term risk remains lower towards the 1.3332/1.3232 levels. That zone is likely to turn the pair higher due to its technical significance.Our overall outlook remains bullish in one(with caution) to three months.

• Dr. Sivaraman: EURO is expected to gain quickly with least selling pressure for year end

• César Leiceaga: Headed towards trendline support in 1.3300/30 now that the weekly close confirmed the top. Some bullish reaction is expected at this levels but long term bias remains bearish.

• ecPulse.com: 1.3250 is the key now. Breaching it will damage any chances for a short term recovery.

• Ilian Yotov: The EUR is still correcting a significant portion of its summer/fall gains vs. USD. The pair could grind even lower, but if more details on the Irish bailout are revealed and if risk appetite makes a comeback, the EUR could catch some bids that could send it back to the upper $1.30's.

• Yohai Elam: Irish debt issues erupted earlier than expected. They will continue weighing on the Euro for quite some time.It seems that we also see an things speeding up regarding Portugal and Spain

• Valeria Bednarik: Breaking the ascendant trend coming from 1.1870 yearly low, pair has set a midterm bearish trend that would likely extend below 1.30 in the upcoming weeks.

..

GBP/USD Comments:

• Mohammed Isah: Bearish nearer term risk continues to dominate after GBP turned lower below the 1.5837 level on Nov 23'10.Further momentum build up should target the 1.5648 level where a cap is expected. Within one(with caution) to three months, we are bullish on the pair.

• Dr. Sivaraman: GBP is expected to make very bullish rise moves till year end

• César Leiceaga: Bullish trendline in 1.5900s eroded this week, waiting for deeper setbacks over the coming months.

• ecPulse.com: The value of 1.5290 is the main technical target over short term basis and the most important factor is the breakout below the uptrend line that carried the wave from 1.4225 to 1.6300

• Ilian Yotov: The GBP could make another attempt at the $1.60's if the U.K. economic data remains strong and if risk appetite makes a comeback after the details on the Irish bailout are revealed.

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

• Valeria Bednarik: Pound remains long term range bound, with a slightly bearish tone, yet only below 1,52, not seen at this point, the bearish trend could be triggered.

..

USD/JPY Comments:

• Mohammed Isah: A lot of price hesitation ahead of the 83.97 level following USDJPY nearer term recovery staged from the 80.23 level is now seen. That level stands between trend continuation and correction. Within one to three months we are bearish on the pair.

• Dr. Sivaraman: YEN is expected to weaken for year end

• César Leiceaga: Gaining upward momentum on the close above 83.00s and consolidating to resume its way up to 86.00 area.

• ecPulse.com: The pair might show some kind of calmness and stability, but an upside price explosion is under preparation according to the pair's behavior around 23.6% fibonacci level for the last downside wave from 95.00 to 80.20.

• Ilian Yotov: Improvement in investor sentiment and risk appetite, coupled with stronger U.S. economic data and higher Treasury yields could become the catalysts for the USD to revisit the post-intervention highs around 86 yen.

• Yohai Elam: A shift in US bonds can support the pair. It seems that USD/JPY found a bottom. There's upside risk for the pair from the Korean crisis, if it doesn't calm down as the markets expect.

• Valeria Bednarik: Unchanged since last updates, the bias remains bullish in the cross. Still 100 DMA around 84.30 remains key level to overcome, to confirm further gains in the upcoming weeks

• Adam Narczewsk: There is still a downside potential for the EUR/USD but I believe in a rebound as the investment world calms down after the "Irish crisis" and takes into account the macro news showing recovery

• Mohammed Isah: With attempts on the upside meeting bear pressure at 1.3781 and turning EUR back lower through the 1.3445 level on Nov 23'10, nearer term risk remains lower towards the 1.3332/1.3232 levels. That zone is likely to turn the pair higher due to its technical significance.Our overall outlook remains bullish in one(with caution) to three months.

• Dr. Sivaraman: EURO is expected to gain quickly with least selling pressure for year end

• César Leiceaga: Headed towards trendline support in 1.3300/30 now that the weekly close confirmed the top. Some bullish reaction is expected at this levels but long term bias remains bearish.

• ecPulse.com: 1.3250 is the key now. Breaching it will damage any chances for a short term recovery.

• Ilian Yotov: The EUR is still correcting a significant portion of its summer/fall gains vs. USD. The pair could grind even lower, but if more details on the Irish bailout are revealed and if risk appetite makes a comeback, the EUR could catch some bids that could send it back to the upper $1.30's.

• Yohai Elam: Irish debt issues erupted earlier than expected. They will continue weighing on the Euro for quite some time.It seems that we also see an things speeding up regarding Portugal and Spain

• Valeria Bednarik: Breaking the ascendant trend coming from 1.1870 yearly low, pair has set a midterm bearish trend that would likely extend below 1.30 in the upcoming weeks.

..

GBP/USD Comments:

• Mohammed Isah: Bearish nearer term risk continues to dominate after GBP turned lower below the 1.5837 level on Nov 23'10.Further momentum build up should target the 1.5648 level where a cap is expected. Within one(with caution) to three months, we are bullish on the pair.

• Dr. Sivaraman: GBP is expected to make very bullish rise moves till year end

• César Leiceaga: Bullish trendline in 1.5900s eroded this week, waiting for deeper setbacks over the coming months.

• ecPulse.com: The value of 1.5290 is the main technical target over short term basis and the most important factor is the breakout below the uptrend line that carried the wave from 1.4225 to 1.6300

• Ilian Yotov: The GBP could make another attempt at the $1.60's if the U.K. economic data remains strong and if risk appetite makes a comeback after the details on the Irish bailout are revealed.

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

• Valeria Bednarik: Pound remains long term range bound, with a slightly bearish tone, yet only below 1,52, not seen at this point, the bearish trend could be triggered.

..

USD/JPY Comments:

• Mohammed Isah: A lot of price hesitation ahead of the 83.97 level following USDJPY nearer term recovery staged from the 80.23 level is now seen. That level stands between trend continuation and correction. Within one to three months we are bearish on the pair.

• Dr. Sivaraman: YEN is expected to weaken for year end

• César Leiceaga: Gaining upward momentum on the close above 83.00s and consolidating to resume its way up to 86.00 area.

• ecPulse.com: The pair might show some kind of calmness and stability, but an upside price explosion is under preparation according to the pair's behavior around 23.6% fibonacci level for the last downside wave from 95.00 to 80.20.

• Ilian Yotov: Improvement in investor sentiment and risk appetite, coupled with stronger U.S. economic data and higher Treasury yields could become the catalysts for the USD to revisit the post-intervention highs around 86 yen.

• Yohai Elam: A shift in US bonds can support the pair. It seems that USD/JPY found a bottom. There's upside risk for the pair from the Korean crisis, if it doesn't calm down as the markets expect.

• Valeria Bednarik: Unchanged since last updates, the bias remains bullish in the cross. Still 100 DMA around 84.30 remains key level to overcome, to confirm further gains in the upcoming weeks

..

Keys:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

SPM & STPM 2010 bermula esok hari.

23 November 2010

Sekadar renungan bersama..

"Berdoa bukan untuk memberitahu ALLAH apa yang kita pinta, kerana

tanpa diberitahu pun ALLAH sedia mengetahui. Doa ialah pengabdian daripada

seorang hamba kepada Tuhannya."

- Majalah SOLUSI, Isu No. 22 -

EUR/USD Comments:

• Cesar Leiceaga: A significant top is in place while we stay below 1.4280. We've seen the weekly close below 1.3700s confirming a further drop to test the main trendline support in 1.3300s over the coming weeks.

• Derek Frey: Near term selling Dollars against all majors but I remain very bullish Dollars over the medium to longer term.

• Dr. Sivaraman: year end and new year beginning could show surprise gains.

• EcPulse.com: 1.3330 MUST hold to keep our monthly & quarterly expectations valid.

• Valeria Bednarik: Current recovery seems mostly corrective in Euro, while below 1.38 price zone. Expect the bearish pressure to persist in the cross in the upcoming weeks.

• Ilian Yotov: If Ireland gets a bailout and if the U.S. economic data weakens further following the disappointing housing starts and inflation reports, the EUR could see a relief rally correcting some of its recent losses vs. USD, as the focus shifts back to the Fed's QE2 impact.

• Mohammed Isah: While it remains vulnerable nearer term, if EUR's current bullish build up continues, we should see that spilling into next week. We are looking for the pair to end its correction and return to the 1.4281 level. Our overall outlook remains bullish in one to three months.

• Yohai Elam: Irish debt issues erupted earlier than expected. They will continue weighing on the Euro for quite some time. It currently seems that we have a "pause" in the crisis in the short term.

GBP/USD Comments:

• Derek Frey: Near term selling Dollars against all majors but I remain very bullish Dollars over the medium to longer term.

• Dr. Sivaraman: year end and new year beginning time could show very surpris rises

• ecPulse.com: 1.5835 MUST hold to keep our Weekly & quarterly expectations valid

• Valeria Bednarik: Still lacking definitions, Pound had a sliglty bullish tone, altought break above 1.63 could turn the cross more bullish.Range however, seems set to persist for at elast another week.

• Ilian Yotov: The GBP could make another attempt at the $1.60's if the U.K. economic data remains strong and if risk appetite makes a comeback after an Irish bailout.

• Mohammed Isah: With its corrective declines halted, we believe bullishness should build up into the coming week with eyes on the 1.4281 level. Between one and three months, we are bullish on the pair.

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

• Derek Frey: Near term selling Dollars against all majors but I remain very bullish Dollars over the medium to longer term.

• Dr. Sivaraman: year end and new year beginning time could show very surpris rises

• ecPulse.com: 1.5835 MUST hold to keep our Weekly & quarterly expectations valid

• Valeria Bednarik: Still lacking definitions, Pound had a sliglty bullish tone, altought break above 1.63 could turn the cross more bullish.Range however, seems set to persist for at elast another week.

• Ilian Yotov: The GBP could make another attempt at the $1.60's if the U.K. economic data remains strong and if risk appetite makes a comeback after an Irish bailout.

• Mohammed Isah: With its corrective declines halted, we believe bullishness should build up into the coming week with eyes on the 1.4281 level. Between one and three months, we are bullish on the pair.

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

USD/JPY Comments:

• Alberto Muñoz: Bullish breakout, expect new short term highs.

• Cesar Leiceaga: The main bearish trendline has been eroded, we need bullish momentum to pick up to validate the recovery. Key resistance to be taken out in 83.00/25.

• Derek Frey: Near term selling Dollars against all majors but I remain very bullish Dollars over the medium to longer term.

• Dr. Sivaraman: year end and new year beginning time could show sudden gains.

• ecPulse.com: Breaching 83.75 could negate the weekly bearishness.

• Valeria Bednarik: Gaining the upside slowly pair has set an interim bottom at the 80.30 price zone; expect recovery to persist despite limited, as long as above 82.00 price zone.

• Ilian Yotov: Improvement in investor sentiment and risk appetite, coupled with stronger U.S. economic data could become the catalysts for the USD to revisit the post-intervention highs around 86 yen.

• Mohammed Isah: With a recovery higher now underway, the pair could be aiming at further higher prices but its overall long term weakness remains valid. Between one and three months we are bearish on USDJPY.

• Yohai Elam: The actions of the BOJ together with a shift in US bonds can support the pair. It seems that USD/JPY found a bottom.

Key:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

• Alberto Muñoz: Bullish breakout, expect new short term highs.

• Cesar Leiceaga: The main bearish trendline has been eroded, we need bullish momentum to pick up to validate the recovery. Key resistance to be taken out in 83.00/25.

• Derek Frey: Near term selling Dollars against all majors but I remain very bullish Dollars over the medium to longer term.

• Dr. Sivaraman: year end and new year beginning time could show sudden gains.

• ecPulse.com: Breaching 83.75 could negate the weekly bearishness.

• Valeria Bednarik: Gaining the upside slowly pair has set an interim bottom at the 80.30 price zone; expect recovery to persist despite limited, as long as above 82.00 price zone.

• Ilian Yotov: Improvement in investor sentiment and risk appetite, coupled with stronger U.S. economic data could become the catalysts for the USD to revisit the post-intervention highs around 86 yen.

• Mohammed Isah: With a recovery higher now underway, the pair could be aiming at further higher prices but its overall long term weakness remains valid. Between one and three months we are bearish on USDJPY.

• Yohai Elam: The actions of the BOJ together with a shift in US bonds can support the pair. It seems that USD/JPY found a bottom.

Key:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

Make Volatility and Risk Work for You with Forex Trading!

.

.

Praise:

.

“This book should be in every trader/investor’s library. As we come out of this depressed market . . . this book can be your companion, helping you avoid mistakes and enhance your trading/investment program.” —Bill M. Williams, author of Trading Chaos

.

“Whether you’re just getting started trading the world’s most exciting financial market, or you’re looking to add to your trading edge, [the authors] have written an engaging book packed with powerful techniques that you can use right now.” —Rob Booker, trader, author, educator, and founder and host of TraderRadio.net

.

.

Preview:

.

The foreign exchange market is the largest trading market in the world, with average daily volume well into the trillions. Because the market is always characterized by high liquidity, forex traders benefit most from volatile markets—making it the ideal investment approach today and well into the future.

.

Mastering the Currency Market is a comprehensive guide to currency and futures trading strategies and techniques for both highly volatile and nonvolatile markets.

.

Putting to work their vast and highly diverse experience in forex trading, the authors explain how to take advantage of the many benefits of foreign exchange trading, including its low cost of entry afforded by margin, and the dynamic pricing by nature of the competitive marketplace. Mastering the Currency Market is divided into five sections covering:

.

The basics of trading currencies

Fundamental analysis of price valuation

Technical analysis and trading charts

Trading philosophy and psychological discipline

Volatility and risk management

.

With four decades of combined experience, the authors clearly communicate to you a trading method that will give you the confidence to both analyze markets and execute trades successfully, regardless of underlying market conditions.

.

As 2008 introduced nightmare scenarios for investors around the world, it was Al Gaskill’s most productive period of his trading career. He used the same trading methods spelled out in this book.

.

Apply the lessons inside and you’ll see profits rise during periods of high market volatility, and when the market slows down, you can downshift to countertrending methods. It’s a win-win investing method, and Mastering the Currency Market leads you through it every step of the way.

.

.

Cataloging:

.

By Jay Norris, Teresa Bell, Al Gaskill

Publisher: The McGraw-Hill Companies, Inc

Number Of Pages: 305

Publication Date: 2010

MHID: 0-07-163484-3

ISBN: 978-0-07-163484-7

Price: USD34.95/MYR139.80

With four decades of combined experience, the authors clearly communicate to you a trading method that will give you the confidence to both analyze markets and execute trades successfully, regardless of underlying market conditions.

.

As 2008 introduced nightmare scenarios for investors around the world, it was Al Gaskill’s most productive period of his trading career. He used the same trading methods spelled out in this book.

.

Apply the lessons inside and you’ll see profits rise during periods of high market volatility, and when the market slows down, you can downshift to countertrending methods. It’s a win-win investing method, and Mastering the Currency Market leads you through it every step of the way.

.

.

Cataloging:

.

By Jay Norris, Teresa Bell, Al Gaskill

Publisher: The McGraw-Hill Companies, Inc

Number Of Pages: 305

Publication Date: 2010

MHID: 0-07-163484-3

ISBN: 978-0-07-163484-7

Price: USD34.95/MYR139.80

SubhanALLAH!

Hanya itu yang termampu aku ucapkan tatkala mendekati iktibar yang ALLAH hamparkan buatku hari ini. Perasaan bercampur-baur antara gembira dan terkilan. Memang sukar sekali untuk ku gambarkan lantaran ianya adalah anugerah yang tidak disangka-sangka pada detik yang juga tidak terjangkakan. Sesungguhnya, hanya Dia yang Maha Mengetahui segala tindakan dan hanyunan langkah kita. Justeru, wajib untuk kita bersangka baik dengan ketentuan & hikmahNya.

Hari ini sangat bererti buatku. Hari ini aku belajar tentang keyakinan dan harga diri, kesungguhan dan istiqamah. Hari ini seharian aku melihat kelibat keyakinan terhadap ilham anugerahNya. Seringkali kita memandang sepi 'halaman' kita lantaran lebih meyakini 'halaman' orang lain. Kita tanpa sedar kerap tidak endah dengan apa yang telah kita miliki kerana bagi kita ia sekadar ilham "kampungan". Namun, setelah diangkat tabir mata, tatkala terpandang ilham kampungan sebegitu digilap dan dicanai sehalus sutera oleh minda dan tangan insan lain yang lebih istiqamah, barulah terdetik perasaan malu dan kesal dalam diri. Rupa-rupanya, ilham yang terbiar lama di sudut indera kita selama ini bernilai jauh lebih berharga daripada yang kita fikirkan jika dimartabat secukupnya dengan kesungguhan dan keyakinan diri. Natijahnya, sememangnya ilham itu adalah anugerah dariNya. Justeru, setiap anugerahNya tidak mungkin bertaraf marhaen melainkan adalah pertunjuk dan pertolongan langsung dariNya, menjawab munajat awal kita kepadaNya.

Astaghfirullah.. Ampuni aku Ya ALLAH kerana mensia-siakan anugerahMu. Akan ku jejak dan kugilap kembali setiapnya agar ianya akan menjuntaikan kunci rahsiaMu itu. InsyaALLAH.

Sesungguhnya kasih-sayang ALLAH terhadap hambaNya mengatasi segala yang ada di cakerawala ini. Betapa beruntungnya kita, kerana kita adalah hambaNya yang terpilih.

Alhamdulillah..

GBP/USD Comments:

• Anna Coulling: Breakout above USD1.6107 key-good platform for sustained move higher.

• ecPulse.com: 1.5965 should hold to keep our overview

• Valeria Bednarik: Consolidation above 1.6000 this week, confirms further upside momentum over the upcoming weeks in the cross.

• Ilian Yotov: The GBP could continue to benefit if the BoE stays on the sidelines with the expansion of its Asset Purchase Program because of stronger-than-expected U.K. economic data.

• Mohammed Isah: Bullish offensive has seen the pair breaking through 1.6105 level on Thursday thus paving the way for additional gains the coming week. Between one and three months, we are bullish on the pair.

• Dr. Sivaraman: Aggressive gains could be seen

• Yohai Elam: In the long term, austerity measures in the UK will hurt the pound.

EUR/USD Comments:

• Anna Coulling: Bullish breakout above USD1.4080 now complete.Strong platform in place for sustained move higher.

• ecPulse.com: 1.3650 should hold to keep our overview,1.4085 must be breached to confirm 1 Week trend.

• Valeria Bednarik: After FOMC, pair is set to extend its gains for the upcoming month, as market temporary ignores sovereign debt woes in Euro zone. Will weight on the cross however, once current excitement settles down.

• Ilian Yotov: Ahead of the Fed's announcement, I was in the "moderate approach" camp, but with the Fed giving the "green light" for additional debasement of the USD, further advancement into the mid $1.40s could be seen if the EUR manages to sustain above $1.40 this time around.

• Mohammed Isah: With a convincing break and hold above the 1.4070/1.4157 levels occurring on Thursday, we see bullish tone extending into next week.Our overall outlook remains bullish in one to three months.

• Dr. Sivaraman: This pair is expected to gain significantly

• Yohai Elam: The Euro will ride the QE decision in the short term

USD/CHF Comments:

• Anna Coulling: Recent small rally snuffed out by longer term moving averages. Its inverse correlation with EUR/USD back in play.

• ecPulse.com: Breaching 0.9550 is needed to confirm 1 quarter trend

• Valeria Bednarik: Bullish correction seems complete, and pair is back lower; probably heading towards fresh lows before a new bottom sets.

• Ilian Yotov: The USD has taken advantage of the opportunity for a more significant price correction of its losses vs. CHF, but further USD debasement could send the pair re-testing recent lows in the mid $0.90s.

• Mohammed Isah: Having lost upside momentum and collapsed off the 0.9970 level, bear pressure is now set to retarget the 0.9462 level and possibly lower. We maintain our bearish outlook on the pair within one to three months.

• Dr. Sivaraman: Contrarian gains are expected much against the expectations

• Yohai Elam: The Swiss Franc enjoys a strong economy and a renewed safe haven status that push it in the short term.

Key:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

Hari ini cuti umum sempena sambutan Deepavali bagi masyarakat berketurunan India. Seharian juga aku sekadar berehat bersama keluarga.

.

Saat ini baru sahaja selesai NFP. Sekitar 10.30pm.

.Alhamdulillah, nampaknya "skill" masih belum berkarat! Walau agak lama tidak berkesempatan turun ke laut jauh, diizinkanNya juga memperolehi rezeki hari ini. Memang sejak akhir-akhir ini, jadual aktiviti harianku dipenuhi dengan acara-acara di pejabat serta urusan perpindahan kediaman keluarga.

.Pun begitu, meski tidak berkesempatan turun jauh ke tengah laut, sesekali sempat juga aku menebar jala & menahan bubu di pinggiran. Kebanyakan masa juga ku habiskan dengan menelaah koleksi buku-buku terbaru berkaitan Forex yang ku beli. Sedikit-sebanyak, dapat juga memperkukuh dan memperbetul kefahaman berkenaannya. Selain "learn" perkara baru, aku juga berkesempatan "re-learn" perkara yang sedia diketahui, di samping "un-learn" perkara-perkara yang selama ini membentuk salah tanggapan terutama konsep dan aspek teknikal dalam dunia Forex. Mmmm.. teringat aku tentang Peter Drucker yang memperkenalkan istilah-istilah tersebut dalam dunia kajian pendidikan dan pembelajaran.

.

Alhamdulillah..

.

Akhir kata, kepada teman-teman berketurunan India - Happy Deepavali!

SubhanALLAH, telah dua minggu rupanya berlalu sejak kali terakhir aku menulis di dada Traderlog ini. Cepat benar masa berlari. Sementelah, tak sampai dua bulan setengah lagi, tahun baru 2011 akan menjelma.

Mmmm.. di mana kita hari ini? Apakah setahun yang hampir berlalu ini telah memberikan erti dan nilai yang lebih baik kepada kita berbanding usia tahun-tahun sebelumnya? Soalan demi soalan berlegar di benak fikirku.

Tentang Forex. Setelah hampir setahun bergiat aktif dengan aktiviti 'bernelayan', aku tersenyum pahit mengenangkannya. Pencarian demi pencarian, semakin hari semakin jauh ke lubuk rahsianya. Hakikatnya, 'kunci rahsia' itu masih belum ku temui. Malahan, setiap hari, semakin banyak 'mangga kunci' yang ku temui. Astaghfirullah.. bukan pula aku mengeluh mempertikaikan ketentuanMu, Ya Rabb. Sekadar cuma aku bermuhasabah menilai perkembangan diri dalam bidang yang semakin hari semakin 'kucintai' ini. Sesungguhnya, petunjuk demi petunjuk yang Kau hamparkan pasti sahaja memberikanku sejuta pengharapan dan kekuatan untuk terus gigih bertatih.

Banyak yang ingin ku tulis. Namun, ruang masa yang semakin terhad memaksaku meneruskan pencarian yang semakin bermakna ini. Biarlah masa yang menentukan. InsyaALLAH, bila detik itu tiba, kisah dan ceriteranya pasti berbeza.

Semoga sinar cahaya redhaMu terus menerangi perjuangan kami, Ya ALLAH.

Amin Ya Rabbal Alamin.

3 hari 2 malam.

Bukannya tempoh pakej percutian, tapi itulah tempoh sedetik ini pelayaranku sejak turun ke laut Isnin lalu. Aku masih "sangkut" di tengah laut. Angin mati pada Isnin, disambut pula oleh sesaran arus yang berterusan ke selatan semalam; nampaknya perit sungguh kali ini! Aku hampir-hampir hanyut lantaran kesilapan perletakan pukat yang berselirat kerana cuba mengimbangi arus yang membadai. Malahan, sebahagian tangkapan terpaksa ku lepaskan kembali ke laut semata-mata bagi memastikan kestabilan Ultimate X5 yang agak terjejas dipukul badai. Syukur ke hadratNya, setidak-tidaknya hari ini aku dibantuNya kembali ke lokasi kemudi yang asal. Alhamdulillah.

Saat ini, aku sedikit lega kerana pukat yang dilabuhkan sudah mulai dipenuhi tangkapan. Namun, alang-alang menyeluk pekasam, biar sampai ke pangkal lengan. Demikian bisik hati kecilku. Aku bercadang untuk terus kekal di tengah lautan sehingga tangkapan maksimum diperolehi. Semoga ALLAH swt mengizinkannya berlaku.

Demikianlah kehidupan seorang nelayan. Ada hari-harinya, pelayaran dan tangkapan begitu mudah dan memuaskan. Namun, seringkali juga laut dan badai menjadi asbab, cuba menguji percaturan strategi yang dibuat. Segala-galanya adalah anugerahNya. Dan sebagai hambaNya, kita hanya mampu merancang.. Dia yang menentukan segalanya.

Semoga Kau memberikan kami petunjuk dan ketabahan untuk melalui ujianMu dengan redha dan jaya.

Amin Ya Rabbal Alamin.

..

The international online Forex broker InstaForex Company is glad to announce to all its numerous clients and partners about launching a mobile version of InstaForex Company official website - mobile.instaforex.com.

The international online Forex broker InstaForex Company is glad to announce to all its numerous clients and partners about launching a mobile version of InstaForex Company official website - mobile.instaforex.com.

..

With the mobile website version each user will be able to find the most topical and necessary information on InstaForex Company and on its activity as well. All trading details, advantages and special offers of InstaForex Company are placed in the website: mobile.instaforex.com.

With the mobile website version each user will be able to find the most topical and necessary information on InstaForex Company and on its activity as well. All trading details, advantages and special offers of InstaForex Company are placed in the website: mobile.instaforex.com.

..

Now wherever you are and no matter what technical instruments you have you can always enter the mobile version of the company’s official website and learn firsthand about the latest news.

Now wherever you are and no matter what technical instruments you have you can always enter the mobile version of the company’s official website and learn firsthand about the latest news.

..

Major sections of mobile.instaforex.com website:

• About Us

• For Traders

• Contests

• For partners

• PAMM-System

• Contacts

Major sections of mobile.instaforex.com website:

• About Us

• For Traders

• Contests

• For partners

• PAMM-System

• Contacts

..

Major website sections in the mobile version - mobile.instaforex.com introduces to the current and future clients the opportunities afforded by the company. From now on it is much easier to present the company to your friends and acquaintances! It is enough to set up in your mobile phone browser Mobile.InstaForex.com and show them a light version of the website wherever you are! In addition to this, the mobile version is targeted to provide its clients the on-time access to such regularly updated data as the contest rates, current quotations on Forex, trading charts and many other options.

Major website sections in the mobile version - mobile.instaforex.com introduces to the current and future clients the opportunities afforded by the company. From now on it is much easier to present the company to your friends and acquaintances! It is enough to set up in your mobile phone browser Mobile.InstaForex.com and show them a light version of the website wherever you are! In addition to this, the mobile version is targeted to provide its clients the on-time access to such regularly updated data as the contest rates, current quotations on Forex, trading charts and many other options.

..

InstaForex Company permanently works on expansion of the services range and their quality refinement. This day was marked by another step forward in the field of the company’s services. We proud of moving ahead and improve daily the reached tops in rendering our services. Be in touch, be with InstaForex – the Best Broker in Asia awarded by the World Finance (2009, 2010)!

InstaForex Company permanently works on expansion of the services range and their quality refinement. This day was marked by another step forward in the field of the company’s services. We proud of moving ahead and improve daily the reached tops in rendering our services. Be in touch, be with InstaForex – the Best Broker in Asia awarded by the World Finance (2009, 2010)!

..

(Posted thru e-mail dated 29 September, 2010)

Review:

Previous Close: 1.5960

+ Average: 1.5996/1.6032/1.6103 (25/50/100)

- Average: 1.5924/1.5888/1.5817 (25/50/100)

..

..

News Pit: 1/2/1 (H/M/L)

Q-Time: am-7.00-2.45-4.00-pm

Remarks: US, JP & CA - Bank Holiday; Friday's bullish expects to maintain & targeting 1.6000

Wave Simulation (Piv): Jeti (U) - Q1 (U) - Q2 (U) - Q3 (U) - pm (Eq) - Jeti (S)

Strategy: Teknik Pukat Bonzai (Z-Type), Teknik Bubu

Session 1/2:

Technique: Teknik Pukat Bonzai (Z-Type)

EET: 5.00am MYT

ELT: 10.00pm MYT

EST: 17hrs

PI/Z Target (Daily): 136

Rev Target (Daily): 73%

MLD: 1% frm Bal

Session 2/2:

Technique: Teknik Bubu

News: GBP

EIT: 7.00am MYT

EET: 6.45am MYT

ELT: 7.15am MYT

EST: 0.5hrs

PI/B Target (Daily): 10

Rev Target (Daily): 27%

MLD: 1% frm Bal

Berkati dan makbulkanlah usaha dan ikhtiarku ini, Ya ALLAH.

Amin Ya Rabbal Alamin.

RESULTS (updated: 20101027, 2.06pm)

Total Daily PI/Z = non-recorded

Total Daily PI/B = non-recorded

Total Daily Rev = non-recorded

Remarks: Trading activities exceeds planned time. Total set-up closed after 4 days with multiple strategies, hence not applicabled with previous planned calculations.

• Anna Coulling: GBP USD running into deep resistance at USD1.60 & above & may begin to stall.

• Dr. Sivaraman: It is expected to make upward shift in trading zone many times during this quarter.

• ecPulse.com: A daily closing above 1.5996 or the psychological levels of 1.6000 confirm monthly and quarterly trend.

• Ian Coleman: Post a new high at 16024 that should be enough to complete C wave. Next wave is down.

• Ilian Yotov: The GBP is taking advantage of the broad USD sell-off, but if the Bank of England stands as the next central bank in line to offer quantitative easing stimulus, the GBP could have a deja-vu experience with 2009-style weakness.

• Yohay Elam: Austerity, unemployment and QE weigh on the pound.

• Valeria Bednarik: Pound remains overall weak, due to self macro dissapointing data. Despite dollar weakness, the upside remains strongly limited.

• Dr. Sivaraman: It is expected to make upward shift in trading zone many times during this quarter.

• ecPulse.com: A daily closing above 1.5996 or the psychological levels of 1.6000 confirm monthly and quarterly trend.

• Ian Coleman: Post a new high at 16024 that should be enough to complete C wave. Next wave is down.

• Ilian Yotov: The GBP is taking advantage of the broad USD sell-off, but if the Bank of England stands as the next central bank in line to offer quantitative easing stimulus, the GBP could have a deja-vu experience with 2009-style weakness.

• Yohay Elam: Austerity, unemployment and QE weigh on the pound.

• Valeria Bednarik: Pound remains overall weak, due to self macro dissapointing data. Despite dollar weakness, the upside remains strongly limited.

Key:

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

• Bearish: Belief that a particular currency is about to fall in value; understood as a general pessimistic trend about the state of that given currency.

• Bullish: Belief that a particular currency is about to rise in value; understood as a general optimism about the state of that given currency.

• Sideways: A sideways trend manifests when the volume of a currency pair bought and the volume of the same pair sold at a particular price are in balance or nearly in balance.

Sumber: Fxstreet.com - Yohay Elam

Sumber: Fxstreet.com - Yohay ElamWith inflation, retail sales, an appearance by Ben Bernanke and many more events, this week will be exciting. Here’s an outlook for the major market-moving events that will shape forex trading.

..

IMF meetings are held during the weekend. This time, the high tensions between countries on currency values make the statements from these meeting very important. The currency war is raging. On Monday, the US, Canada and Japan are on holidays. This means thinner volume and that the echoes from the Non-Farm Payrolls and the IMF will move the markets. And then we have a fresh flow of data:

* All times are GMT

* All times are GMT

..

1. British inflation data: Published on Tuesday at 8:30. British inflation remains above the government target, fueling calls for a rate hike, despite the fragile situation in the UK. It’s expected to stubbornly remain at the same level it was at last month – 3.1% (annualized. Any result will rock the pound. Note that after this release, Mervyn King and some of colleagues appear in parliament and will publicly testify on inflation and the economy.

.

2. US FOMC Meeting Minutes: Tuesday, 18:00. The recent decision by Bernanke and co. gave the first hints about a possibility of further dollar printing in the upcoming meeting in November. This statement will provide further details, and will expose the differences inside the central bank – some want a totally different policy. This will rock the markets, despite the relatively late hour.

.

3. British employment data: Wednesday, 8:30. While higher inflation boosts the Pound, the job market weakens it. Claimant Count Change, the earliest job report in the UK, is expected to show another rise in the number of unemployed people – 2.8K, similar to last month. The unemployment rate is expected to remain unchanged at 7.8%.

.

4. US Federal Budget Balance: Wednesday, 18:00. The huge deficit in that the US government has is painful for the dollar. In the past two months, this deficit was slightly smaller than expected. It’s expected to squeeze this time again – from 90 to 52 billion. Only a surplus will give a serious boost to the dollar, but this is unlikely now.

.

5. US Unemployment Claims: Thursday, 12:30. Last week’s weekly jobless claims report exceeded expectations and gave hope for a positive NFP. From 445K, the figure is now expected to rise back to 452K. Only a drop under 430K will show that the job market is significantly improving. A rise above 500K will be very worrying.

.

6. US PPI: Thursday, 12:30. Producer prices were slightly higher than expected last month – 0.4%, but this still doesn’t reflect an inflationary change. PPI is expected to edge up at a slower rate this time – 0.2%. Core PPI is likely to copy last month’s rise – a modest 0.1%.

.

7. American and Canadian trade balance: Thursday, 12:30. This double-feature release provides high volatility for USD/CAD. The American deficit is expected to remain almost unchanged at 43 billion, while the Canadian deficit is expected to squeeze from 2.7 to 2.1 billion. The impact of the weaker dollar probably won’t be reflected in this release.

.

8. Ben Bernanke talks: Friday, 12:15. The chairman of the Federal Reserve will speak in Boston, and might shed more light on possible quantitative easing moves in the upcoming meeting in November. He’ll also have a chance to comment on the recent jobs report. Even if Bernanke doesn’t say anything significant, the markets rock.

.

9. US CPI: Friday, 12:30. The hawks at the Federal Reserve are weak – inflation is very tame, and there’s no urge for tightening steps. The Consumer Price Index (CPI) is expected to rise by 0.2%, slower than last month’s 0.3% rise. Core CPI, that remained unchanged last time, is expected to rise by a very-modest 0.1%. Only rises above 0.5% will cause worries.

.

10. US Retail Sales: Friday, 12:30. This is a key indicator of consumers’ moods. Retail sales rose steadily in the past two months – 0.4%. A 0.5% rise is expected now. Core retail sales, which are carefully watched by the Federal Reserve, are expected to rise by 0.4%. The simultaneous release of CPI and sales will create high volatility.

.

11. US Consumer Sentiment: Friday, 13:55. This highly regarded survey by the University of Michigan supplies a strong ending for the week. The initial release will probably show a rise from 68.2 to 69.1 points. The indicator already reached 76 points a few months ago.

..

That’s it for the major events this week. Stay tuned for coverages on specific currencies.

(Published on Sat, Oct 9 2010, 13:56 GMT)

(Published on Sat, Oct 9 2010, 13:56 GMT)

Genap sejam dari waktu aku menulis ini, tanggal 10 Oktober 2010 akan menghadirkan dirinya ke dalam kalendar Masihi dunia.

Entah kenapa, tarikh itu begitu ku nantikan. Tiada yang istimewa sebenarnya, sekadar mungkin kerana angka 10.10.10 itu ku lihat sangat "catchy". Bagiku, secara peribadi, ia berpotensi untuk dijadikan titik permulaan 'kesempenaan' untuk mencapai resolusi terkiniku.

Resolusi? Bukankah lebih baik menunggu tahun baru yang tidak sampai 3 bulan lagi akan bermula? Mmmm.. tahun baru muncul setiap tahun, namun 10.10.10 mungkin hanya muncul sekali dalam sejarah hayatku (mengambil fitrah usia Rasulullah saw 63 tahun!).

OK! Makanya, resolusi itu harus benar-benar "gedang" dan hebat!

InsyaALLAH.. malahan, aku meletakkan "limit-order" buat diri sendiri agar Fasa I yang merujuk kepada 'tapak asas & cerucuknya' ku siapkan selengkapnya selewat-lewatnya menjelang 12.00 tengahmalam terakhir 2010 ini. Dan selepas itu, semoga ALLAH terus memberikan kekuatan untukku menerus & melestarikan fasa-fasa yang seterusnya. Amin Ya ALLAH!

Details? Hematku, tak perlu lah dipaparkan di sini. Memadai dikongsi bersama insan-insan tersayang..

Selamat Datang 10.10.10.. Selamat Datang Cita-citaku!!

Pohon dimakbulkan olehMu, Ya ALLAH!

Amin Ya Rabbal Alamin.

Artikel berikut dipetik daripada www.forextofreedom.com

(Ref: posted on 12 January 2010 by Perry)

-----------------------------------------------------------

-----------------------------------------------------------

.

This is an extremely effective forex strategy that I use for trading the Non Farm Payroll numbers. This strategy can be used on any news announcement, the key to trading this strategy is you want a substantial fundamental surprise. What I mean by this is you are looking for a dramatic change in the actual number compared with the forecast number. The bigger the surprise the better the opportunity exists for profits. What this surprise creates for technical traders is momentum and momentum means OPPORTUNITY.

.

I Love the Non-Farm Payroll as in my honest opinion it is the best trading day of the month, If I were to only trade once a month then this would be it and as I have stated many times, you only need to master one trading method and you are on your way toward financial freedom. This would give anyone a realistic chance to trade as it requires only one day a month of your time and you really only need to trade for about five to six hours and your done. It is quite easy and far less time consuming as other methods to back-test as well.

I Love the Non-Farm Payroll as in my honest opinion it is the best trading day of the month, If I were to only trade once a month then this would be it and as I have stated many times, you only need to master one trading method and you are on your way toward financial freedom. This would give anyone a realistic chance to trade as it requires only one day a month of your time and you really only need to trade for about five to six hours and your done. It is quite easy and far less time consuming as other methods to back-test as well.

.

I know a lot of people who won’t go near the market on this day as they are scared due to the volatility but it is this volatility that creates the best opportunities!

I know a lot of people who won’t go near the market on this day as they are scared due to the volatility but it is this volatility that creates the best opportunities!

.

When there is no surprises in the announcement and I am not looking at any other trades on the higher time frames I will just turn off the computer and take the day of as it will generally be a choppy one.

When there is no surprises in the announcement and I am not looking at any other trades on the higher time frames I will just turn off the computer and take the day of as it will generally be a choppy one.

.

First thing we need to do is identify what is a surprise so we know when to trade and not to trade. A surprise has to be a very substantial shift in the number from the forecasted number. I will use last months as an example as this is exactly what happened and thus there was a great opportunity for profits.

First thing we need to do is identify what is a surprise so we know when to trade and not to trade. A surprise has to be a very substantial shift in the number from the forecasted number. I will use last months as an example as this is exactly what happened and thus there was a great opportunity for profits.

.

Now before I go any further there a many ways to trade these large announcements and over time I intend to cover a lot more of these but for today I am only going to discuss this one strategy to try and simplify things. For the numbers I will use Forex Factories calender as it is available to all and quite reliable. The only downfall to this is the number is generally delayed for two to three minutes but as this trading strategy is not about trading the news it is fine for this purpose.

Now before I go any further there a many ways to trade these large announcements and over time I intend to cover a lot more of these but for today I am only going to discuss this one strategy to try and simplify things. For the numbers I will use Forex Factories calender as it is available to all and quite reliable. The only downfall to this is the number is generally delayed for two to three minutes but as this trading strategy is not about trading the news it is fine for this purpose.

.

Here I have inserted a picture of their calender on the day:

Here I have inserted a picture of their calender on the day:

(Pls refer Pic 1 above)

.

You will note that the previous months number was 4k or four thousand more employed people than the previous month. This month the forecast is that there will be 3000 less employed people than last month, now look at the actual number. There was actually 85000 less employed people than the previous month and 82000 less than the forecast.

.

You will note that the previous months number was 4k or four thousand more employed people than the previous month. This month the forecast is that there will be 3000 less employed people than last month, now look at the actual number. There was actually 85000 less employed people than the previous month and 82000 less than the forecast.

.

This is a great example of a fundamental surprise, now if the number had been only 50k or less I would not trade. When the surprise is less substantial the trading day tends to get very choppy and therefore much more challenging to trade. What we are seeking is a very definite indication of market direction and when the surprise is large generally you will see the market move in the direction of the surprise. In this example the USA had 85000 less jobs and this is not good at all for their economy and therefor not good for their currency. The outcome is a weakening of the US Dollar or inversely a strengthening of there cross pair.

This is a great example of a fundamental surprise, now if the number had been only 50k or less I would not trade. When the surprise is less substantial the trading day tends to get very choppy and therefore much more challenging to trade. What we are seeking is a very definite indication of market direction and when the surprise is large generally you will see the market move in the direction of the surprise. In this example the USA had 85000 less jobs and this is not good at all for their economy and therefor not good for their currency. The outcome is a weakening of the US Dollar or inversely a strengthening of there cross pair.

.

In this example I will use the Eur/Usd pair. So this number should see a substantial bull move in the Euro due to the sudden weakness in the greenback and this is exactly what happened:

(Pls refer Pic 2 above)

In this example I will use the Eur/Usd pair. So this number should see a substantial bull move in the Euro due to the sudden weakness in the greenback and this is exactly what happened:

(Pls refer Pic 2 above)

.

Now for the rules:

• We trade the 5 min chart

• First and foremost, we are only interested in trading in the direction of this fundamental shift so in this scenario we are only looking to buy or go long.

• We do not trade at all for the first fifteen minutes after the news is released.

• For the divergence I use the Stochastic Oscillator and the settings I use are 5,3,3.

• What I am looking for is divergence between the oscillator and price to give me a signal to take a long position.

Now for the rules:

• We trade the 5 min chart

• First and foremost, we are only interested in trading in the direction of this fundamental shift so in this scenario we are only looking to buy or go long.

• We do not trade at all for the first fifteen minutes after the news is released.

• For the divergence I use the Stochastic Oscillator and the settings I use are 5,3,3.

• What I am looking for is divergence between the oscillator and price to give me a signal to take a long position.

.

OK lets walk through the setup know and see just how to trade it. Once the news has been released we wait patiently for the first fifteen minutes and then we can start looking for our entry. There was an opportunity in this instance that appeared just shy of two hours later. After I have identified the divergence I then need to calculate my position size.

OK lets walk through the setup know and see just how to trade it. Once the news has been released we wait patiently for the first fifteen minutes and then we can start looking for our entry. There was an opportunity in this instance that appeared just shy of two hours later. After I have identified the divergence I then need to calculate my position size.

.

For this trade we placed our entry after the stochastic turned up confirming the divergence and also signaling our entry, this was at 1.4322. To calculate our position size we need to know where our stop is and in this instance we would place our stop below the previous low, this was at 1.4294, this gave us a stop-loss of 28 pips.

For this trade we placed our entry after the stochastic turned up confirming the divergence and also signaling our entry, this was at 1.4322. To calculate our position size we need to know where our stop is and in this instance we would place our stop below the previous low, this was at 1.4294, this gave us a stop-loss of 28 pips.

.

I will just go through how I calculate this just for those that are unsure. We will assume that I have a trading capital of $10 000 and am risking 1% of capital per trade. So 1% of 10k is $100 dollars, to calculate my position size i simply divide 100 by my risk of 28 pips which would give me 100/28=3.5. This equates to either 3 mini lots or 35 micro lots depending on your trading platform.

I will just go through how I calculate this just for those that are unsure. We will assume that I have a trading capital of $10 000 and am risking 1% of capital per trade. So 1% of 10k is $100 dollars, to calculate my position size i simply divide 100 by my risk of 28 pips which would give me 100/28=3.5. This equates to either 3 mini lots or 35 micro lots depending on your trading platform.

.

All that’s left to do now is place your target and for this I would use the previous high and this was at 1.4400. This particular trade had a total risk of 28 pips and a total reward of 78 pips so a risk to reward ratio of 2.8:1.

All that’s left to do now is place your target and for this I would use the previous high and this was at 1.4400. This particular trade had a total risk of 28 pips and a total reward of 78 pips so a risk to reward ratio of 2.8:1.

.

Here is an image of the trade:

(Pls refer Pic 3 above)

.

This is a simple strategy that is very effective if you have the patience to wait for the setup and the control to sit by and watch some very substantial moves that generally precede this trade. This is the trade in its simplest form, I have an advanced way I trade this setup and that is once the divergence is confirmed I look for a significant candlestick pattern to give me an entry and a stop position. What I look for is either an engulfing pattern, a pin bar or an Inside bar to trigger the trade and then place my stop on the other side of the pattern.

Here is an image of the trade:

(Pls refer Pic 3 above)

.

This is a simple strategy that is very effective if you have the patience to wait for the setup and the control to sit by and watch some very substantial moves that generally precede this trade. This is the trade in its simplest form, I have an advanced way I trade this setup and that is once the divergence is confirmed I look for a significant candlestick pattern to give me an entry and a stop position. What I look for is either an engulfing pattern, a pin bar or an Inside bar to trigger the trade and then place my stop on the other side of the pattern.

.

In this particular scenario you could have used the breakout above the inside bar and placed your stop just below it. What this achieves is a much smaller stop and thus the potential for larger position size and thus greater profits. In this case our entry would have been at 1.4321 with our stop at 1.4305. This would have reduced our stop to only 16 pips allowing us to take a position of 6 mini lots or 6.2 micro lots.

In this particular scenario you could have used the breakout above the inside bar and placed your stop just below it. What this achieves is a much smaller stop and thus the potential for larger position size and thus greater profits. In this case our entry would have been at 1.4321 with our stop at 1.4305. This would have reduced our stop to only 16 pips allowing us to take a position of 6 mini lots or 6.2 micro lots.

.

Now this also offers greater potential of being stopped out so it totally depends on your appetite for risk as to the way you personally take these trades. I am inclined to take the lowest risk trades as I have learn t that risk is the only thing I have any control over in this game and when I am right I prefer to be positioned well for it.

Now this also offers greater potential of being stopped out so it totally depends on your appetite for risk as to the way you personally take these trades. I am inclined to take the lowest risk trades as I have learn t that risk is the only thing I have any control over in this game and when I am right I prefer to be positioned well for it.

.

So from here if this style of trading appeals to you then back-test it, try it and then implement it into your arsenal of trading tools.

So from here if this style of trading appeals to you then back-test it, try it and then implement it into your arsenal of trading tools.

.

I have a few other methods that I use to trade the NFP but will save those for another article.

I have a few other methods that I use to trade the NFP but will save those for another article.

.

- Perry -

Copyright © ForextoFreedom

Copyright © ForextoFreedom

"Kita perlukannya Bro.. Paling tidak satu pip!" Demikian ujarku kepada Bert.

..

Masih terngiang-ngiang di telingaku perbincangan dengan Bert di tepi gerai tasik Serdang selepas solat Jumaat tadi. Perbincangan yang mulanya santai bertukar menjadi lebih serius. Mujurlah, suasana hangat gerai yang bumbungnya dipanah sinar mentari sebelumnya, bertukar dingin lantaran hujan yang semakin lebat.

..

Bukan rahsia lagi. Bert sudahpun tendered resignation letter bulan lepas. Ertinya, hujung November ini adalah hari terakhir tugasannya di pejabat. Kali ini aku memang tidak mampu menahan. Hakikatnya tekanan kerja yang semakin memuncak sememangnya sudah tidak lagi sesuai buat "belia" seusia kami yang semakin hari semakin rapuh kepada serangan sindrom-sindrom penyakit moden. Tambahan pula masing-masing memasang impian tinggi untuk menjadikan "laut" sebagai sumber rezeki yang lebih baik.

..

Pun begitu, aku cuba memberikan suatu perspektif luar-jangka kepadanya. Bukan rahsia juga bahawa 90% trader di luar sana gagal. Dan hanya separuh daripada baki 10% yang tinggal adalah trader yang benar-benar mampu menguasai pencak silat Mr Market. Fakta ini bukan lagi omongan kosong, malah hampir semua traders mengetahuinya sejak hari pertama mengenali "lautan forex". Ironinya, hampir kesemuanya juga yang menjadi penyumbang statistik fakta tersebut, setidak-tidaknya di awal-awal pembabitan, termasuklah aku!

..

Sudahkah kita berada di kelompok 5% terbaik itu? Atau paling tidak, kelompok 5% di bawahnya yang "lebih banyak trade untung berbanding rugi". Mmmm.. tepuk dada, tanya hati, dan lihat trading history..

..